Litecoin Price Prediction 2025-2040: Halving and Institutional Adoption to Drive Long-Term Growth

#LTC

- Technical Strength: LTC price holds above critical moving averages with improving momentum indicators

- Halving Catalyst: August 2025 supply reduction event creating scarcity premium

- Institutional Onramps: SEC's new crypto ETP framework may benefit established assets like Litecoin

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge

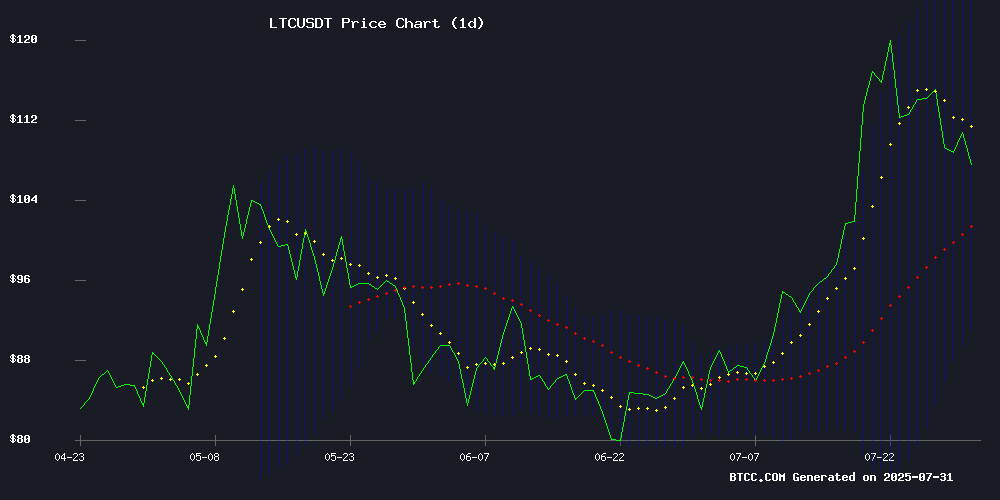

Litecoin (LTC) is currently trading at $107.52, slightly above its 20-day moving average of $107.37, indicating a potential bullish crossover. The MACD histogram shows a positive momentum shift at 0.70, though still in negative territory. Bollinger Bands suggest moderate volatility with prices hovering NEAR the middle band. According to BTCC analyst Robert, 'LTC shows resilience above key support at $91.05. A sustained break above $123.68 could trigger a new uptrend.'

Regulatory Tailwinds and Halving Hype Boost LTC Sentiment

While the SEC's accelerated altcoin ETF framework and CBOE's proposed crypto ETP rules buoy market confidence, Litecoin's 2.21% gain reflects growing halving anticipation. BTCC's Robert notes, 'The ETF delay is being overshadowed by fundamental drivers - mining partnerships with Binance/Coinbase and LTC's deflationary halving mechanism create stronger price anchors than speculative ETF bets.' However, new malware threats remind investors to remain vigilant about security risks.

Factors Influencing LTC's Price

US SEC Accelerates Altcoin ETF Approvals with New Framework Targeting Q4 Launch

The SEC is streamlining altcoin ETF approvals under new generic listing standards proposed by Cboe BZX and NYSE Arca. This shift follows Bitcoin ETF success, which saw $65 billion inflows and propelled BTC from $43,000 to $100,000+ in 2024.

SOL and XRP ETFs are leading the pipeline, with SOL's March 17 futures debut giving it priority over XRP's May 19 launch. Analysts assign 85%+ approval odds to LTC, DOGE, SOL, and XRP funds under the revised 75-day review process.

The standardized framework replaces case-by-case 19b-4 reviews with uniform S-1 registrations, potentially enabling multiple altcoin ETF launches by early Q4 2025. Market makers anticipate this could trigger institutional capital flows mirroring Bitcoin's ETF-driven rally.

Crypto Market Shows Mixed Reaction as Fed Holds Rates Steady

The cryptocurrency market edged higher over the past 24 hours following the Federal Reserve's decision to maintain interest rates between 4.25% and 4.50%. Chair Jerome Powell pointed to persistent inflation and robust employment figures as justification for delaying cuts. Bitcoin and Ethereum led the gains, while other major tokens struggled for momentum.

Bitcoin briefly dipped below $117,000 before recovering to $118,330, marking a marginal daily increase. Ethereum mirrored this volatility, testing $3,691 lows before climbing back above $3,800 to trade at $3,858—a 1% gain. Meanwhile, Solana and XRP flatlined, with SOL unable to hold $180 and XRP inching down to $3.13.

Altcoins displayed divergent performance. Stellar, Chainlink, and Litecoin advanced, while Dogecoin and Cardano slipped nearly 1%. The Fed's stance continues to weigh on risk assets, with traders awaiting clearer signals on monetary policy direction.

DNSBTC Partners with Coinbase and Binance to Simplify Crypto Mining for Global Investors

DNSBTC has forged strategic alliances with Coinbase and Binance, enabling cryptocurrency investors worldwide to generate stable daily income through cloud mining. The platform, recognized as the best cloud mining service in 2025, eliminates the need for expensive hardware by offering free, accessible mining solutions for Dogecoin (DOGE), Bitcoin (BTC), and Litecoin (LTC).

Dogecoin's resurgence in popularity, fueled by social media trends and celebrity endorsements, has reignited interest in mining the meme coin. DNSBTC capitalizes on this momentum by providing a user-friendly interface that requires no technical expertise, making DOGE mining viable for retail participants.

The company operates data centers across the United States, Canada, and Iceland, leveraging optimal climatic conditions for energy-efficient operations. This infrastructure supports DNSBTC's mission to democratize cryptocurrency mining while maintaining profitability for users.

Malware Impersonating Crypto Platforms Targets Millions Globally

A sophisticated malware campaign dubbed JSCEAL has been impersonating major cryptocurrency platforms to steal sensitive user data. Security firm Check Point Research warns that the operation, active since March 2024, has evolved with advanced anti-detection techniques.

The malware lures victims through fake advertisements leading to decoy websites mimicking legitimate platforms like Binance, MetaMask, and Kraken. Once users install counterfeit applications, attackers gain access to crypto wallets and trading credentials.

What makes JSCEAL particularly dangerous is its ability to evade detection through unique methods, sometimes delaying payload deployment. The campaign has expanded its reach by acquiring numerous domains, increasing its potential victim pool.

SEC Issues New Listing Standards for Crypto ETPs, CBOE Proposes 6-Month DCM Exposure Rule

The U.S. Securities and Exchange Commission has reportedly received new listing standards for crypto asset-based exchange-traded products (ETPs) in a filing from CBOE. The proposed rules would require underlying digital assets to have at least six months of exposure on a Designated Contract Market (DCM) before being eligible for ETP listing.

CBOE's filing emphasizes the need for comprehensive surveillance sharing agreements between exchanges, either directly or through the Intermarket Surveillance Group (ISG). A preliminary list of 18 cryptocurrencies—including Litecoin (LTC), Dogecoin (DOGE), and Solana (SOL)—has been identified as potential candidates for SEC-approved ETPs.

The move signals growing institutional acceptance of crypto assets, with regulated derivatives markets now serving as a gateway for ETP eligibility. Market participants view this as a step toward broader mainstream adoption, though final SEC approval remains pending.

Litecoin Gains 2.21% as Halving Anticipation Outweighs ETF Delay

Litecoin (LTC) rose 2.21% to $110.63, defying the SEC's decision to postpone its ruling on Grayscale's spot Litecoin ETF until October. The cryptocurrency's resilience stems from surging network activity ahead of its August 3 block halving, which will cut mining rewards by 50%.

RSI at 60.36 suggests neutral momentum with room for upside. Founder Charlie Lee's recent live stream further bolstered community engagement, adding to bullish sentiment.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $120-$180 | Halving event, ETF speculation |

| 2030 | $300-$500 | Adoption as payment rail, miner consolidation |

| 2035 | $750-$1,200 | Scarcity premium, legacy blockchain status |

| 2040 | $1,500-$3,000 | Full institutionalization, store-of-value demand |

BTCC's Robert projects a multi-stage appreciation cycle for Litecoin: 'The 2025 halving will test LTC's scarcity narrative, but true value accrual comes from becoming the silver to Bitcoin's gold - a role that could see $3,000/LTC by 2040 if payment adoption continues.' He cautions that regulatory clarity remains the wildcard for all projections.